It's a pandemic – is my financial plan at risk?

With widespread financial fears around coronavirus/COVID-19, Craig Dealey shares advice and insights from the team at NZFP.

- Take sensible actions

- Increase levels of hygiene

- Prepare for self-isolation

- Ensure you are self-reliant in case this goes on for longer than expected

How NZFP is adapting to the situation:

As a business, NZFP is well positioned to do our part to reduce the spread of coronavirus:

- All of our offices and staff are set up to work remotely as needed, while still keeping in contact with clients.

While we prefer to work face to face, we can do so electronically or over the phone as a stop gap. - We are avoiding unnecessary business travel and risky contact where we can.

We have robust health and safety protocols in place along with business continuity plans in the face of natural disasters and events such as this. - Clients’ funds are all held in trust with separate custodian and registry providers overseeing values and regular transactions.

The systems that administer client portfolios have continuity plans in place. These systems are regularly tested to ensure client access to funds, accurate pricing, and integrity of the assets can be maintained.

Will my financial plan implode?

In short, no.

A properly constructed, comprehensive financial plan is exactly what everyone should have right now.

If you already have a financial plan with NZFP, you have a clear picture of your long-term position. Our plans help take the emotion out of financial decision making and ensure you stay on track to get to where you want to be.

By having a plan and working with your advisor, you’re in the best position to put significant events, such as this one, into context – and understand how they impact your ability to meet the goals you have set.

The coronavirus outbreak reinforces the need for good financial advice.

Our advice process helps you:

- Understand and manage risks

- Take care of day to day needs

- Insure the things you can’t afford to lose

- Put aside sufficient savings to see you through in the future if/when your working income ceases.

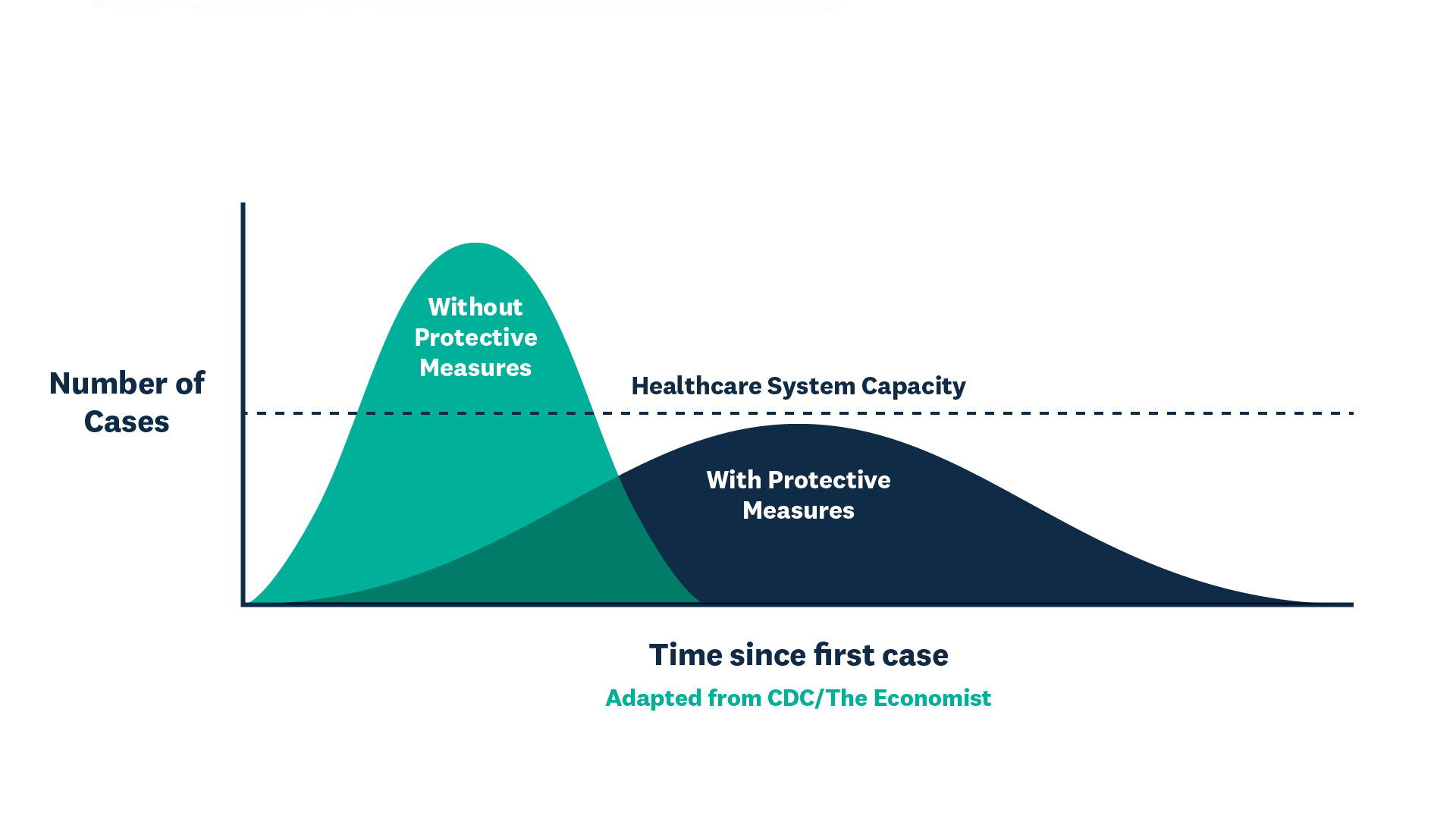

One of the key elements in our advice process at NZFP is to identify your risk profile.

Knowing your risk profile allows us to assess what your comfort levels are around investment volatility and exposures – then test this against the amount of risk you need to take in order to achieve your goals.

This process allows you to make better informed decisions, and have peace of mind that you can withstand portfolio movements at times when there are sudden changes in the market.

Talk through your concerns and decisions with your advisor.

Given the recent dramatic movements in financial markets, you might be getting to a point where your comfort levels are being tested. Fear and concern can lead many to make rash decisions about their money, more often than not at precisely the wrong time.

NZFP’s advisors are positioned to offer informed and realistic advice during tricky financial times.

Whilst our advisors might not be able to solve all the problems immediately, and the current situation is certainly daunting, our clients have the peace of mind that an expert has their best interests at heart.

Your financial advisor will look at the bigger picture for you – and make sure you’re still on track to reach your goals.

Things will look scary right now.

Unless you've got all your cash in a term deposit or hidden in a box under the bed, you will have no doubt seen a rapid fall in the value of your financial assets over the past few weeks.

Will things get worse before they get better? Yes, possibly.

Will the crazy times be over soon or last a long time? No one can know for sure.

The best thing to do is check to see what the impact may be on your plan and goals right now. By reviewing your plan with your financial advisor to assess where you’re at, you will either know that you are in a relatively stable position even after a major event like we have experienced, or you will know that there are some potential shortfalls that will need to be addressed through adjustments to your plan.

Either way, you have taken back control and can feel more secure knowing that things are either:

- OK, or

- By modifying some behaviors and adjusting your financial plan with new saving and spending levels, you can get back on track.

Other potential scenarios:

- If you have time on your side, you have the luxury of being able to ride out the crisis and benefit from the eventual recovery.

You also have the capacity to continue saving, which will mean you'll be buying into markets on the way down, in essence getting more for every dollar as things get cheaper. - If you're no longer saving, then now might be a good time to consider delaying some of those big-ticket item expenditures.

- Don’t cash up investments just at the time when they are worth less than they should be.

Once your investments are sold, you can never benefit from a recovery in prices, so in essence you'd be locking in a hard cash loss.

For all of the above scenarios, your advisor can help you model the likely outcomes and effectively plan your spending and saving activities. Just like the process of creating your financial plan, all ongoing advice and adjustments are tailored to suit your unique goals, requirements, and risk profile.

Take a sensible approach to your financial affairs

If you have a KiwiSaver portfolio, it will have also been impacted by recent market moves. But don't rush out to see if you can shift it to a low risk or cash strategy right now. The time to do that was before it all started, but no-one knows in advance when things turn or how quickly.

If you can resist the temptation, avoid looking at your KiwiSaver values every day completely. They’ll be volatile and seeing that won’t help you sleep any better at night.

Rather than making a rash decision, speak to your advisor and make sure you aren't in a fund that is too risky for your profile. Ideally, your fund is suitable for your longer term KiwiSaver needs and is properly diversified so that you’re not putting all the investment eggs into one basket.

Your financial advisor will help you take care of your insurance needs and make sure that your life, health, income and assets are appropriately covered.

If you haven't reviewed your insurance in a while, now is the perfect time to review this with your advisor so that you can minimise the stresses that events such as this may bring. The same goes for having your wills, enduring powers of attorney, and trusts all up to date and properly documented. It’s about focussing on the things that you can take control of and removing stresses where you can.

Even during today’s crisis, we’ll maximise your chances of getting to where you need to be.

From an investment perspective, NZFP’s approach has always been focused on long-term success, managing risks as effectively as possible.

While no one has a crystal ball to foresee extreme events, especially global health shocks such as coronavirus, we can avoid taking unnecessary or unintended risks. With a properly researched and focused process for investment, we identify risks and diversify away from them where possible.

By regularly rebalancing portfolios, we effectively buy more good assets as prices get cheaper, like now, and sell them as the prices are going up. This has the effect of reducing the overall risk that clients need to take on whilst potentially achieving a better overall outcome for investors.

“In situations like what we face today, NZFP’s disciplined approach to financial planning is our secret weapon.

While that doesn’t mean we’re immune to the economical effects of coronavirus, our attention and understanding of risks, proper diversification, and a disciplined process supports our clients with a journey that is as smooth as possible.

By sticking to your plan and working with your advisor, you have the capacity to reach your goals and sustain the lifestyle you want to enjoy long-term.

A financial plan with NZFP is an undeterred focus on your future wellbeing, while giving you enough peace of mind right now to navigate through challenging times and events – making only the necessary well-informed adjustments as you go.”

Craig Dealey

General Manager, NZFP